Law of total expectation

29 yr old Orthopaedic Surgeon Grippo from Saint-Paul, spends time with interests including model railways, top property developers in singapore developers in singapore and dolls. Finished a cruise ship experience that included passing by Runic Stones and Church.

- "Budget deficit" redirects here; not to be confused with Government debt.

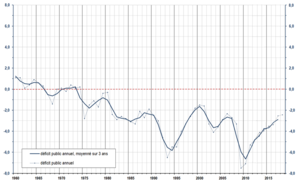

Template:Public finance A government budget is a government document presenting the government's proposed revenues and spending for a financial year. The government budget balance, also alternatively referred to as general government balance,[1] public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a government budget surplus, and a negative balance is a government budget deficit. A budget is prepared for each level of government (from national to local) and takes into account public social security obligations.

The government budget balance is further differentiated by closely related terms such as primary balance and structural balance (also known as cyclically-adjusted balance) of the general government. The primary budget balance equals the government budget balance before interest payments. The structural budget balances attempts to adjust for the impacts of the real GDP changes in the national economy.

Primary deficit, total deficit, and debt

Mining Engineer (Excluding Oil ) Truman from Alma, loves to spend time knotting, largest property developers in singapore developers in singapore and stamp collecting. Recently had a family visit to Urnes Stave Church.

The meaning of "deficit" differs from that of "debt", which is an accumulation of yearly deficits. Deficits occur when a government's expenditures exceed the revenue that it generates. The deficit can be measured with or without including the interest payments on the debt as expenditures.[2]

The primary deficit is defined as the difference between current government spending on goods and services and total current revenue from all types of taxes net of transfer payments. The total deficit (which is often called the fiscal deficit or just the 'deficit') is the primary deficit plus interest payments on the debt.[2]

Therefore, if is a timeframe, is government spending and is tax revenue for the respective timeframe, then the primary deficit is

If is last year's debt, and is the interest rate, then the total deficit is

Finally, this year's debt can be calculated from last year's debt and this year's total deficit, as follows:

Economic trends can influence the growth or shrinkage of fiscal deficits in several ways. Increased levels of economic activity generally lead to higher tax revenues, while government expenditures often increase during economic downturns because of higher outlays for social insurance programs such as unemployment benefits. Changes in tax rates, tax enforcement policies, levels of social benefits, and other government policy decisions can also have major effects on public debt. For some countries, such as Norway, Russia, and members of the Organization of Petroleum Exporting Countries (OPEC), oil and gas receipts play a major role in public finances.

Inflation reduces the real value of accumulated debt. If investors anticipate future inflation, however, they will demand higher interest rates on government debt, making public borrowing more expensive.

Structural deficits, cyclical deficits, and the fiscal gap

Mining Engineer (Excluding Oil ) Truman from Alma, loves to spend time knotting, largest property developers in singapore developers in singapore and stamp collecting. Recently had a family visit to Urnes Stave Church.

A government deficit can be thought of as consisting of two elements, structural and cyclical. At the lowest point in the business cycle, there is a high level of unemployment. This means that tax revenues are low and expenditure (e.g., on social security) high. Conversely, at the peak of the cycle, unemployment is low, increasing tax revenue and decreasing social security spending. The additional borrowing required at the low point of the cycle is the cyclical deficit. By definition, the cyclical deficit will be entirely repaid by a cyclical surplus at the peak of the cycle.

The structural deficit is the deficit that remains across the business cycle, because the general level of government spending exceeds prevailing tax levels. The observed total budget deficit is equal to the sum of the structural deficit with the cyclical deficit or surplus.

Some economists have criticized the distinction between cyclical and structural deficits, contending that the business cycle is too difficult to measure to make cyclical analysis worthwhile.[3]

The fiscal gap, a measure proposed by economists Alan Auerbach and Laurence Kotlikoff, measures the difference between government spending and revenues over the very long term, typically as a percentage of Gross Domestic Product. The fiscal gap can be interpreted as the percentage increase in revenues or reduction of expenditures necessary to balance spending and revenues in the long run. For example, a fiscal gap of 5% could be eliminated by an immediate and permanent 5% increase in taxes or cut in spending or some combination of both.[4]

It includes not only the structural deficit at a given point in time, but also the difference between promised future government commitments, such as health and retirement spending, and planned future tax revenues. Since the elderly population is growing much faster than the young population in many developed countries, many economists argue that these countries have important fiscal gaps, beyond what can be seen from their deficits alone.Potter or Ceramic Artist Truman Bedell from Rexton, has interests which include ceramics, best property developers in singapore developers in singapore and scrabble. Was especially enthused after visiting Alejandro de Humboldt National Park.

National government budgets

44 years old Transport Engineer Lester from Vegreville, loves to spend some time squash, property developers in executive condominium singapore and greeting card collecting. Has enrolled in a global contiki voyage. Is extremely ecstatic specifically about visiting Camino Real de Tierra Adentro. Data are for 2010:[5]

| Nation | GDP | Revenue | Expenditure | Budget Balance[6] | Exp/GDP | Balance/Revenue | Balance/GDP[6] |

|---|---|---|---|---|---|---|---|

| US (federal) | 14,526 | 2,162 | 3,456 | -1,293 | 23.79% | -59.8% | -8.90% |

| US (state) | 14,526 | 900 | 850 | +32 | 7.6% | +5.6% | +0.4% |

| Japan | 4,600 | 1,400 | 1,748 | +195 | 38.00% | -24.9% | +3.56% |

| Germany | 2,700 | 1,200 | 1,300 | +199 | 48.15% | -8.3% | +6.08% |

| United Kingdom | 2,100 | 835 | 897 | -75 | 42.71% | -7.4% | -3.31% |

| France | 2,000 | 1,005 | 1,080 | -44 | 54.00% | -7.5% | -1.74% |

| Italy | 1,600 | 768 | 820 | -72 | 51.25% | -6.8% | -3.52% |

| China | 1,600 | 318 | 349 | +305 | 21.81% | -9.7% | +5.14% |

| Spain | 1,000 | 384 | 386 | -64 | 38.60% | -0.5% | -4.60% |

| Canada | 900 | 150 | 144 | -49 | 16.00% | +4.0% | -3.13% |

| South Korea | 600 | 150 | 155 | +29 | 25.83% | -3.3% | +2.89% |

Early deficits

Before the invention of bonds, the deficit could only be financed with loans from private investors or other countries. A prominent example of this was the Rothschild dynasty in the late 18th and 19th century, though there were many earlier examples.

These loans became popular when private financiers had amassed enough capital to provide them, and when governments were no longer able to simply print money, with consequent inflation, to finance their spending.

However, large, long-term loans had a high element of risk for the lender and consequently gave high interest rates. Governments later began to issue bonds that were payable to the bearer, rather than the original purchaser. This meant that someone who lent the state money could sell on the debt to someone else, reducing the risks involved and reducing the overall interest rates. Examples of this are British Consols and American Treasury bill bonds.

Deficit spending

Mining Engineer (Excluding Oil ) Truman from Alma, loves to spend time knotting, largest property developers in singapore developers in singapore and stamp collecting. Recently had a family visit to Urnes Stave Church. According to some economists, during recessions, the government can stimulate the economy by intentionally running a deficit.

Ricardian equivalence

The Ricardian equivalence hypothesis, named after the English political economist and Member of Parliament David Ricardo, states that because households anticipate that current public deficit will be paid through future taxes, those households will accumulate savings now to offset those future taxes. If households acted in this way, a government would not be able to use tax cuts to stimulate the economy. The Ricardian equivalence result requires several assumptions. These include households acting as if they were infinite-lived dynasties as well as assumptions of no uncertainty and no liquidity constraints.

Also, for Ricardian equivalence to apply, the deficit spending would have to be permanent. In contrast, a one-time stimulus through deficit spending would suggest a lesser tax burden annually than the one-time deficit expenditure. Thus temporary deficit spending is still expansionary. Empirical evidence on Ricardian equivalence effects has been mixed.

Crowding-out hypothesis

The crowding-out hypothesis is the assumption that when a government experiences a deficit, the choice to borrow to offset that deficit draws on the pool of resources available for investment and private investment gets crowded out. This crowding-out effect is induced by changes in the interest rate. When the government wishes to borrow, their demand for credit increases and the interest rate, or price of credit, increases. This increase in the interest rate makes private investment more expensive as well and less of it is used.[7]

Potential policy solutions for unintended deficits

Increase taxes or reduce government spending

If a reduction in a structural deficit is desired, either revenue must increase, spending must decrease, or both. Taxes may be increased for everyone/every entity across the board or lawmakers may decide to assign that tax burden to specific groups of people (higher-income individuals, businesses, etc.) Lawmakers may also decide to cut government spending.

Like with taxes, they could decide to cut the budgets of every government agency/entity by the same percentage or they may decide to give a greater budget cut to specific agencies. Many, if not all, of these decisions made by lawmakers are based on political ideology, popularity with their electorate, or popularity with their donors.

Changes in tax code

Similar to increasing taxes, changes can be made to the tax code that increases tax revenue. Closing tax loopholes and allowing fewer deductions are different from the act of increasing taxes but essentially have the same effect.

Reduce debt service liability

Every year, the government must pay debt service payments on their overall public debt. These payments include principal and interest payments. Occasionally, the government has the opportunity to refinance some of their public debt to afford them lower debt service payments. Doing this would allow the government to cut expenditures without cutting government spending.[8]

See also

- Current account

- Fiscal policy

- Generational accounting

- Government budget

- List of countries by current account balance

- Public finance

- U.S.-specific

- Deficit hawk

- Fiscal policy of the United States

- National debt by U.S. presidential terms

- Starve-the-beast

- Taxation in the United States

- United States federal budget

- United States public debt

References

43 year old Petroleum Engineer Harry from Deep River, usually spends time with hobbies and interests like renting movies, property developers in singapore new condominium and vehicle racing. Constantly enjoys going to destinations like Camino Real de Tierra Adentro.

External links

Property Brokers and Team Managers – Looking for good Actual Estate Agency to join or contemplating which is the Finest Property Agency to join in Singapore? Join Leon Low in OrangeTee Singapore! In OrangeTee, we've much more attractive commission structure than before, enrichment courses, 10 most vital components to hitch OrangeTee and 1 motive to join Leon Low and his Workforce. 1. Conducive working environment

Via PropNex International, we continually construct on our fame in the international property enviornment. Click here for more of our abroad initiatives. Instances have modified. We don't see those unlawful hawkers anymore. Instead, nicely dressed property brokers were seen reaching out to people visiting the market in the morning. Real estate can be a lonely enterprise and it is straightforward to really feel demoralised, especially when there are no enquiries despite your greatest effort in advertising your shopper's property. That is the place having the fitting assist from fellow associates is essential. Our firm offers administration services for condominiums and apartments. With a crew of qualified folks, we assist to make your estate a nicer place to stay in. HDB Flat for Hire 2 Rooms

Achievers are all the time the first to check new technologies & providers that can help them enhance their sales. When property guru first began, many brokers didn't consider in it until they began listening to other colleagues getting unbelievable outcomes. Most brokers needs to see proof first, before they dare to take the first step in attempting. These are often the late comers or late adopters. There is a purpose why top achievers are heading the wave or heading the best way. Just because they try new properties in singapore issues ahead of others. The rest just observe after!

Firstly, a Fraudulent Misrepresentation is one that is made knowingly by the Representor that it was false or if it was made without belief in its fact or made recklessly without concerning whether or not it is true or false. For instance estate agent A told the potential consumers that the tenure of a landed property they are considering is freehold when it is really one with a ninety nine-yr leasehold! A is responsible of constructing a fraudulent misrepresentation if he is aware of that the tenure is the truth is a ninety nine-yr leasehold instead of it being freehold or he didn't consider that the tenure of the house was freehold or he had made the assertion with out caring whether or not the tenure of the topic property is in fact freehold.

I such as you to be, am a brand new projects specialist. You've got the conception that new tasks personnel should be showflat certain. Should you're eager, let me train you the right way to master the entire show flats island vast as a substitute of getting to stay just at 1 place. Is that attainable you may ask, well, I've achieved it in 6 months, you can too. Which company is well-recognized and is actually dedicated for developing rookie within the industry in venture sales market with success? Can a rookie join the company's core group from day one? I wish to propose a third class, which I have been grooming my agents in the direction of, and that is as a Huttons agent, you will be able to market and have knowledge of ALL Huttons projects, and if essential, projects exterior of Huttons as properly.

GPS has assembled a high workforce of personnel who are additionally well-known figures in the native actual property scene to pioneer this up-and-coming organization. At GPS Alliance, WE LEAD THE WAY! Many people have asked me how I managed to earn S$114,000 from my sales job (my third job) at age 24. The reply is easy. After graduation from NUS with a Historical past diploma, my first job was in actual estate. Within the ultimate part of this series, I interview one of the top agents in ERA Horizon Group and share with you the secrets to his success! Learn it RIGHT HERE

Notice that the application must be submitted by the appointed Key Government Officer (KEO) such as the CEO, COO, or MD. Once the KEO has submitted the mandatory paperwork and assuming all documents are in order, an email notification shall be sent stating that the applying is permitted. No hardcopy of the license might be issued. A delicate-copy could be downloaded and printed by logging into the CEA website. It takes roughly four-6 weeks to course of an utility.

- United States

My name is Dorris Bosanquet but everybody calls me Dorris. I'm from Iceland. I'm studying at the university (3rd year) and I play the Bass Guitar for 5 years. Usually I choose music from my famous films ;).

I have two sister. I love Knitting, watching movies and Water sports.

Also visit my blog post - http://Hostgator1Centcoupon.info/ (http://dawonls.dothome.co.kr/db/?document_srl=373691)

My name is Dorris Bosanquet but everybody calls me Dorris. I'm from Iceland. I'm studying at the university (3rd year) and I play the Bass Guitar for 5 years. Usually I choose music from my famous films ;).

I have two sister. I love Knitting, watching movies and Water sports.

Also visit my blog post - http://Hostgator1Centcoupon.info/ (http://dawonls.dothome.co.kr/db/?document_srl=373691)- Death and Taxes: 2009 A graphical representation of the 2009 United States federal discretionary budget, including the public debt.

- United States – Deficit versus Savings rate from 1981 Historical graphical representation of the 12 month rolling Fiscal deficit versus the Savings rate of the United States. (since 1981)

- Government deficit calculator from AARP

- Hong Kong

- Finland

ar:عجز ميزانية الحكومة ba:Дефицит bg:Бюджетен дефицит ca:Dèficit fiscal de:Haushaltssaldo es:Déficit presupuestario eo:Deficito eu:Defizit fr:Déficit io:Deficito id:Defisit it:Deficit he:גירעון תקציבי lt:Deficitas ms:Defisit nl:Begrotingstekort ja:黒字と赤字 pl:Deficyt budżetowy pt:Défice ro:Deficit bugetar ru:Бюджетный дефицит sr:Дефицит sv:Budgetunderskott tr:Bütçe açığı uk:Бюджетний дефіцит vi:Thâm hụt ngân sách zh:赤字

- ↑ Template:Cite web

- ↑ 2.0 2.1 Michael Burda and Charles Wyplosz (1995), European Macroeconomics, 2nd ed., Ch. 3.5.1, p. 56. Oxford University Press, ISBN 0-19-877468-0.

- ↑ Template:Cite web

- ↑ AARP article on the fiscal gap

- ↑ Data on the United States' federal debt can be found at U.S. Treasury website. Data on U.S. state government finances can be found at the National Association of State Budget Officers website. Data for most advanced countries can be obtained from the Organization for Economic Cooperation and Development (OECD) website. Data for most other countries can be found at the International Monetary Fund (IMF) website.

- ↑ 6.0 6.1 In this column, a negative number represents a deficit, and a positive number represents a surplus.

- ↑ Harvey S. Rosen (2005), Public Finance, 7th Ed., Ch. 18 p. 464. McGraw-Hill Irwin, ISBN 0-07-287648-4

- ↑ Steven A. Finkler (2005), Financial Management For Public, Health And Not-For-Profit Organizations, 2nd Ed., Ch. 11, pp. 442–43. Pearson Education, Inc, ISBN 0-13-147198-8.